$$$

When people say a house is an investment, they’re usually speaking about home equity. So, what is equity, why would you want it, how can you get more of it, and more importantly, how can you keep it?

Home equity is the portion of your home’s current value that you possess at any given time. It is the difference between what your home is worth and what you owe on the mortgage loan.

You can borrow from your equity as a loan, invest it, build long-term wealth with it, or sell your home for more than what you owe and pocket the difference.

The Importance of Building Your Home Equity

Building equity increases the amount of money you have in your home that you may utilize now or in the future.

When you build equity, it means that you increase the difference between your home value and the amount you owe on your mortgage.

You can do this by increasing your home’s value through improvements or decreasing the amount of money you owe on your mortgage, such as by paying it down by making larger principal payments.

Note that not all changes a homeowner makes to improve their property necessarily boosts its value, so we encourage you to do your research.

Selling & Collecting On the Equity That You’ve Built

Selling Your Home

When you sell your home, the proceeds from the sale will first go towards paying off your remaining mortgage balance. After this is paid, the seller is then responsible for paying their portion of the closing costs.

The real estate agents commissions, title insurance fees, recording fees, transfer taxes, property taxes and mortgage origination fees are all then taken from the sale proceeds of the home at closing.

The money that is left over is what you get to keep as profit or use to buy another home. The more equity you have, the more money you’ll make at the end of the home sale process.

In California, unfortunately, we have the nation’s fourth highest closing costs according to data from CoreLogic’s ClosingCorp – that of which the seller will typically have to pick up the tab on the majority of these costs.

Note that in some instances, you’ll also need to pay a capital gains tax on the money you make from the sale.

Collecting on Your Home Equity

So, once you’ve built up the equity in your home, it’s common sense to think that one day you will want to collect on all of the equity that you worked so hard to build.

After all, you did earn it, right?

However, when you choose to use a realtor in a traditional real estate transaction, collecting your home equity in full is truly an impossible feat – as you probably recognized from the real estate expenses mentioned in the section above.

In fact, you’d be surprised at the amount of equity a home seller loses during a typical real estate transaction.

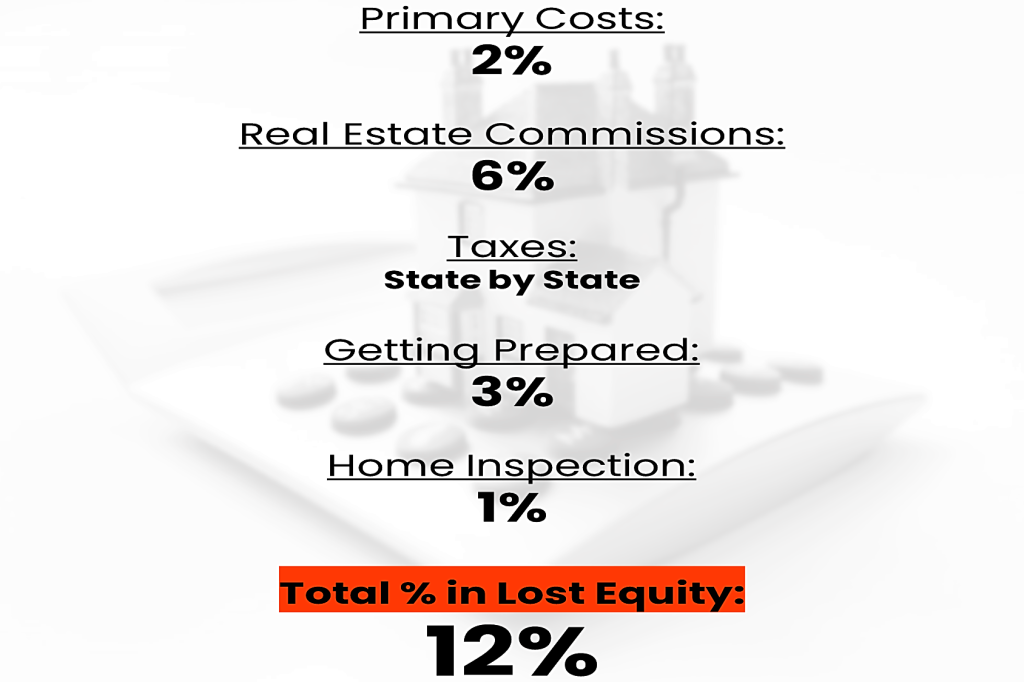

The costs above show that sellers on average will lose about 12% of their equity when they close with a traditional transaction. (source: My Home by Freddie Mac)

(And don’t forget… if you’re using a real estate attorney, you’ll have to cover those fees as well.)

No matter what state you live in, the costs of traditional real estate transactions have sellers thinking about coming up with a lot more than just their home’s listing price.